In fact, over 8,000 biological pharmaceutical products are currently under clinical investigation worldwide. Given the evident benefits of biologics over small molecule drugs (including high efficacy, target specificity and favorable safety profiles), the biopharmaceutical market is poised to witness continued and consistent growth over the next several years. However, biological therapeutics are inherently less stable than small molecules and, hence, more prone to degradation by several physical and chemical degradation mechanisms. Therefore, a variety of excipients, which are pharmacologically inert substances themselves, are used to stabilize biologics during the manufacturing process and storage. Furthermore, excipients play a critical role in biologics development by enhancing the solubility and bioavailability, controlling pH and tonicity of the active pharmaceutical ingredients (APIs). Additionally, biopharmaceutical excipients act as bulking agents, antioxidants or preservatives. As a result, the demand for biopharmaceutical excipients has grown considerably. However, for some of the biopharmaceutical excipients, such as lipids, the associated manufacturing processes are highly complex, capital-intensive and fraught with multiple challenges. Some of the major issues related to the production of GMP grade biopharmaceutical excipients include the need for specialized expertise, lack of facilities with the necessary infrastructure and capacity to produce the required quality of substances, as well as concerns related to storage, safety and efficacy.

Considering the technical and routine operations-related challenges, an increasing number of biologics developers are increasingly relying on biopharmaceutical excipient manufacturers. The benefits of engaging such third-party service providers are numerous; for instance, contracting a supplier for medical grade biopharmaceutical excipients enables sponsors to leverage specialty biopharmaceutical excipients (available with the manufacturers), access larger capacities and achieve greater operational flexibility. Biopharmaceutical excipients can range from simple inert entities to complex compounds. In the last decade, biopharmaceutical excipient development has advanced significantly, resulting in more complex excipients that can be formulated as novel drug delivery formulations.

Presently, there are several contract manufacturers that claim to have the required capabilities to manufacture a variety of biopharmaceutical excipients, including lipids, lactose, trehalose, mannitol, succinate, Tween 20 and benzyl alcohol. These companies are increasingly focusing on the development of co-processed multifunctional biopharmaceutical excipients to improve the stability and effectiveness of novel biotherapeutics. It is worth highlighting that biopharmaceutical excipient manufacturers are actively trying to consolidate their presence in this field by entering into strategic alliances, enhance their respective manufacturing capabilities in order to meet the growing demand for excipients used in biologics. In fact, recently, a number of deals were inked between vaccine developers and biopharmaceutical excipient manufacturers in order to cater to the urgent need for lipids for the formers’ respective COVID-19 vaccines. With outsourcing being increasingly accepted as a viable and beneficial business model within this field, we anticipate the biopharmaceutical excipient manufacturing market to grow at a steady pace in the coming years.

The Evolving Landscape of Biopharmaceutical Excipient Manufacturing Domain

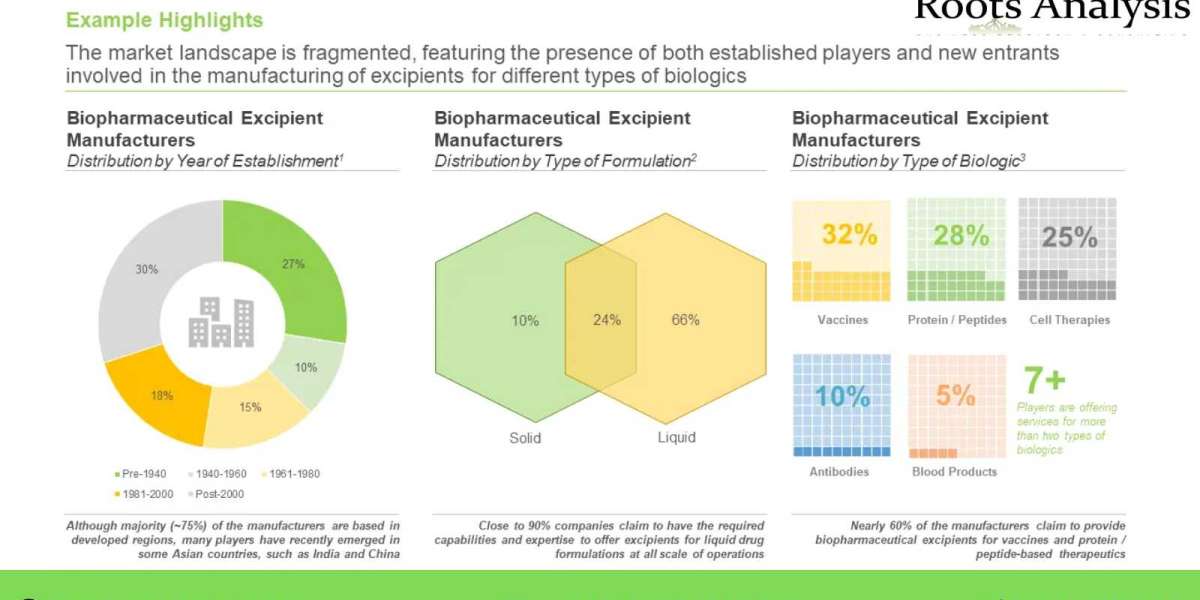

During our research, we identified over 40 players that offer manufacturing services of biopharmaceutical excipients. The market is dominated by the companies based in developed regions, which account for nearly 75% of biopharmaceutical excipient manufacturers. The growing demand for solid and liquid excipients for manufacturing of different type of biologics, has spurred the establishment of many companies in the last decades.

Growing Number of Partnerships Validate the Interest in this Industry

With growing number of approvals of biological therapies, the need of partner for biopharmaceutical excipients is also increasing. In the last few years, established players have forged multiple intercontinental and intracontinental deals for biopharmaceutical excipients. It is worth mentioning that 60% of the deals were established post-2019

Future Evolution of Biopharmaceutical Excipient Manufacturing Market

The growing number of biological therapies approvals often demands constant innovation to improve their excipient properties to make a safe and stable formulation. Over the last three decades, biopharmaceutical excipient manufacturers have developed several classes of functional excipients which are proven to improve the solubility, stability and efficacy of the majority of the new biological therapies. Additionally, biopharmaceutical manufacturers have developed some exceptional excipients which claims to increase the biopharmaceutical formulation shelf life by three times. Driven by the increasing number of biological therapies approvals, significant developments, encouraging partnerships and growing demand for biopharmaceutical excipient manufacturing market is anticipated to grow at a CAGR of ~6%, for the period 2022-2035.

For additional details, please visit https://www.rootsanalysis.com/blog/biopharmaceutical-excipient-manufacturing-current-scenario-and-future-trends/ or email [email protected]

You may also be interested in the following titles:

- Flow Cytometry Service Market, 2022-2035

- Gene Editing beyond CRISPR Market, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact Information

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091