Roots Analysis has announced the addition of Cell and Gene Therapy CRO Market , 2022-2035” report to its list of offerings.

In order to mitigate the challenges associated with the cell and gene therapies research and development, around 50-60% of the developers prefer to outsource their operations to contract research organizations (CROs), which claim to have the required expertise and experience to leverage their capabilities and yield cost savings opportunities. The aforementioned challenges are believed to be the key factors for driving the outsourcing of research operations to a cell and gene therapy CRO , which claim to be well-aware of the nuances of advanced therapy medicinal products (ATMP) design and development, as well as cell and gene therapy manufacturing process.

Key Market Insights

Presently, more than 105 players claim to offer cell and gene therapy contract research services

The cell and gene therapy industry is dominated by the presence of mid-sized (51-500 employees) and small (2-51 employees) players, which collectively represent more than 70% of the total CROs in this domain. In addition, about 20% of the firms were founded post 2010.

40% of the players carry out contract research operations across preclinical and clinical scales

Nearly 21% of the total industry stakeholders have the required capabilities for cell and gene therapies at the commercial scale. In addition, 16% CROs are capable of providing contract research services for discovery purposes.

Partnership activity in this domain has increased at a CAGR of over 61%, during 2015- 2022

Acquisitions and mergers emerged as the most popular type of partnership model adopted by industry stakeholders (54%), followed by service agreements (20%). Further, most of the deals were inked by players based in North America (58%).

Over 32 mergers and acquisitions were established in this domain, during the period 2015-2022

It was observed that majority of the deals were intracontinental (72%), involving participants from different countries. Geographical consolidation and portfolio addition were observed to be the major key value drivers of MA activity, followed by service portfolio and geographical expansion (28%, each).

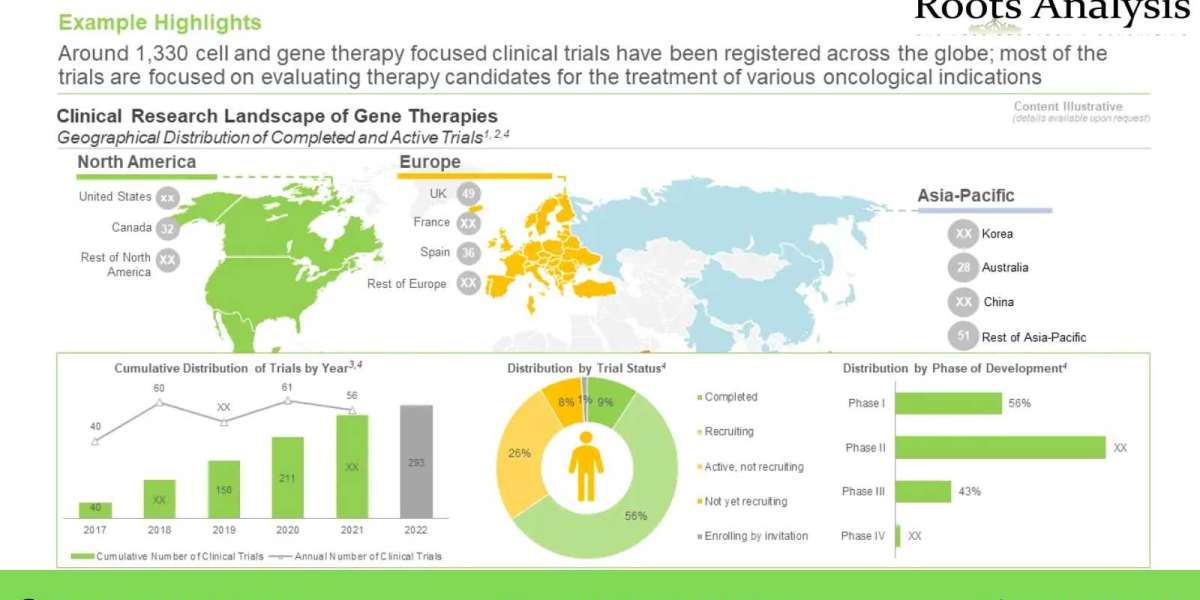

More than 1,330 clinical trials evaluating cell and gene therapies have been registered worldwide

Of the total, close to 79% of the studies are active and recruiting patients, followed by those that have already been completed (7%). It is important to highlight that more than 20% of cell and gene therapy focused-clinical trials are currently in phase II.

North America and Europe are anticipated to capture over 75% of the market share, in 2035

In terms of scale of operation, the current market is driven by clinical operations (55%); this trend is unlikely to change in the foreseen future as well. Further, based on area of expertise, majority of the revenue share (61%) of the overall market in 2035 is likely to be driven by cell therapies.

To request a sample copy / brochure of this report, please visit

https://www.rootsanalysis.com/reports/230/request-sample.html

Key Questions Answered

- Who are the leading players engaged in offering cell and gene therapy related research services?

- Which business models are most commonly adopted by biopharmaceutical developers for outsourcing cell and gene therapies?

- Which partnership models are commonly adopted by stakeholders engaged in this industry?

- What are the key value drivers of the merger and acquisition activity in the cell and gene therapy market?

- Which players are likely to partner with cell and gene therapy CROs?

- Which regions emerged as the key hubs for carrying out clinical studies focused on cell and gene therapies?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What are the anticipated future trends related to cell and gene therapy related research services?

The financial opportunity within the cell and gene therapy CROs market has been analyzed across the following segments:

- Area of Expertise

- Cell Therapy

- Gene Therapy

- Scale of Operation

- Preclinical

- Clinical

- Drug Discovery

- Therapeutic Area

- Oncological Disorders

- Neurological Disorders

- Cardiovascular Disorders

- Infectious Diseases

- Metabolic Disorders

- Autoimmune Disorders

- Blood Disorders

- Rare / Genetic Disorders

- Ophthalmic Disorders

- Other disorders

- Analysis by Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

The report includes profiles of key players (listed below) engaged in the offering CRO services for cell and gene therapies, across both preclinical and clinical scales of operation; each profile features a brief overview of the company, along with details related to its cell and gene therapies-related service portfolio, recent developments, and an informed future outlook.

- Altasciences

- Allucent

- Charles River Laboratories

- Creative Biolabs

- IQVIA

- Medpace

- PPD

- Precision for Medicine

- QPS

- Accelera

- Evotec

- ICON

- Syneos Health

- CMIC Group

- Labcorp

For additional details, please visit

https://www.rootsanalysis.com/reports/view_document/cell-and-gene-therapy-cros-market/230.html

You may also be interested in the following titles:

- Gene Therapy Market: (5TH Edition) Industry Trends and Global Forecasts, 2022-2035

- RNA Sequencing Services Market: Industry Trends and Global Forecasts, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415