In addition, over the next five years, the global pharmaceutical market is projected to grow at a CAGR of 4.7%, with global drug sales anticipated to raise revenues worth USD 1.5 trillion in 2023. This continuously growing pipeline of pharmaceutical drug products has inadvertently led to an increase in the demand for their associated primary packaging and Secondary Packaging solutions. Specifically, pharmaceutical secondary packaging is a vital step in the product supply chain as it encloses life-saving drugs and therapies, preserving the identity, quality, integrity and stability of the packaged drug product. It also plays a key role in marketing and brand projection for a product. However, the process of secondary packaging usually involves time consuming and complex activities, such as blister carding, thermoforming, labeling, kitting, assembly and cold chain storage (for temperature sensitive biologics). Other key challenges faced by developers are limiting variability in packaging materials and ensuring compliance to stringent regulatory guidelines (for packaging designs). Considering the aforementioned concerns, many pharmaceutical players now prefer to collaborate with qualified packaging providers that offer non-traditional packaging solutions and have the required capabilities to create unique packaging designs, in a cost and time effective manner. As per the CDMO Outsourcing Survey conducted by Nice Insight, specifically for clinical and commercial scale operations, nearly 60% of the pharmaceutical companies currently outsource their primary packaging needs, while 43% of the players outsource their secondary packaging requirements. Driven by the ongoing innovation in this field, continuous growth in the pharmaceutical drugs pipeline and a steady rise in drug approvals, the pharmaceutical secondary packaging market is likely to witness positive growth in the foreseen future.

Diverse Landscape of Pharmaceutical Secondary Packaging Providers

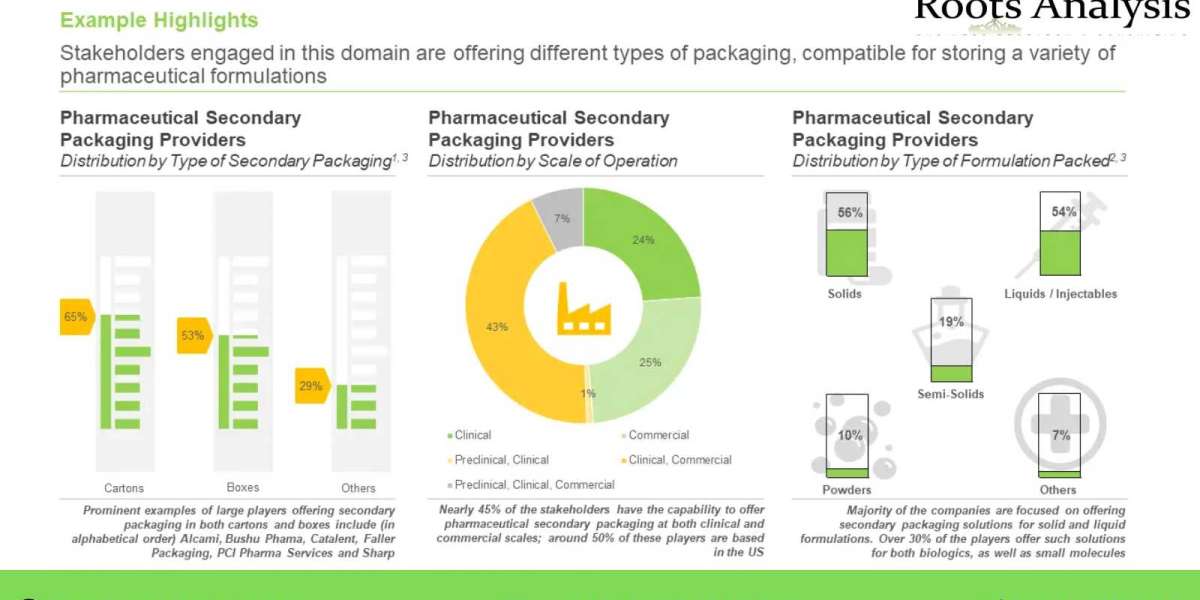

During our research, we came across more than 160 players, which claim to offer pharmaceutical secondary packaging services. As per our analysis, blisters are the prominent type of packaging containers for which majority of the companies offer its pharmaceutical secondary packaging services. This is followed by companies offering secondary packaging services for vials and bottles.

Company Competitiveness Analysis

With so many players in the market, it may become baffling to decide which company would serve your purpose. Some companies do have advantages over other competitors, in terms of their experience, types of secondary packaging solutions offered, type of primary packaging packed, and additional services being offered. With the intention to develop a better understanding of the overall potential and capabilities of industry players involved in this domain, we carried out a company competitiveness analysis of the various stakeholders, based on location of their headquarters and company size.

The Increasing Interest in this Field is also Reflected in Recent Partnership Activity

Since 2018, partnership activity within the pharmaceutical secondary packaging domain has increased with an annualized growth rate of 85%. Acquisitions have captured a substantial share in the partnerships related to pharmaceutical secondary packaging, during the period of 2018-2021. This was followed by manufacturing and packaging agreements, which have captured a significant share of the partnerships inked in this domain. Further, the maximum number of partnerships in this domain was observed in 2020, followed by those signed in 2021. This rise in partnership activity in the last two years can be attributed to the increasing demand of pharmaceutical secondary packaging providers to meet the drug supply demand amidst the COVID-19 pandemic.

Demand Analysis

The demand for pharmaceutical secondary packaging, across various packaging formats, is anticipated to grow at an annualized rate of ~8% in the coming years. Presently, boxes and cartons hold the maximum share of the overall demand, followed by demand for pouches. This trend could be attributed to the various advantages offered by boxes and cartons, such as protection, lightweight, versatility and convenience to mold into various flexible packaging forms.

For additional details, please visit

https://www.rootsanalysis.com/blog/rising-demand-for-pharmaceutical-secondary-packaging-providers/ or email [email protected]

You may also be interested in the following titles:

- Biologics Fill Finish Services Market (3rd Edition), 2022-2035

- Bioavailability Enhancement Technologies and Services Market, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415