London

Roots Analysis has announced the addition of “ADC Contract Manufacturing Market (5th Edition), 2022-2035” report to its list of offerings.

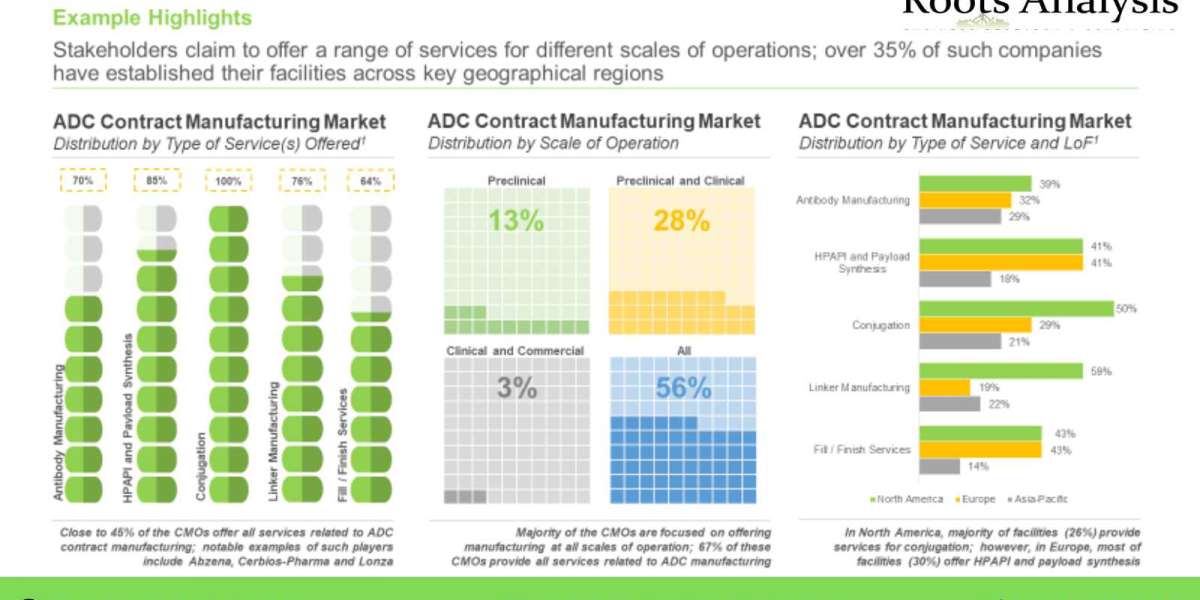

In order to mitigate the challenges associated with Antibody Drug Conjugate manufacturing, around 70-80% of the therapeutics developers prefer to outsource their operations to contract manufacturing organizations (CMOs), which claim to have the required expertise and experience to leverage their capabilities and yield cost savings opportunities.

To request a sample copy / brochure of this report, please visit

https://www.rootsanalysis.com/reports/218/request-sample.html

Key Market Insights

Presently, more than 30 players claim to offer ADC contract manufacturing services

This segment of the industry is dominated by the presence of large (more than 501 employees) and mid-sized (51-500 employees) players, which collectively represent more than 80% of the total contract manufacturers in this domain. In addition, around15% firms were established post 2010.

More than 84 expansions were reported in this industry, during 2012-2021

Of the total, 57% instances were focused on enhancing dedicated capabilities and capacities, followed by those carried out for the expansion / establishment of manufacturing facilities (42%).

Partnership activity in this domain has increased at a CAGR of over 16%, during 2016- 2021

Manufacturing agreements emerged as the most popular type of partnership model adopted by industry stakeholders (18%), followed by product development agreements (16%) and research agreements (15%). Further, most of the deals were inked by players based in Europe (46%).

Global, installed ADC contract manufacturing capacity is currently estimated to be close to 33 Kilograms

The maximum share of the current installed capacity is expected to be captured by large players. Moreover, close to 37% of the installed manufacturing capacity is available in the Asia-Pacific region.

140,200+ patients have been enrolled in over 714 clinical trials, worldwide

Clinical research activity, in terms of number of trials registered, is reported to have increased at a CAGR of 21%, in the past three years. Of the total number of trials, close to 47% of the studies are recruiting patients, while 30% have been completed.

Global demand for ADC contract manufacturing is anticipated to grow at a CAGR of 13%, during 2022-2035

The commercial demand for ADC therapeutics is projected to increase at a CAGR of 22%. Further, the clinical demand for ADC therapeutics in phase III trials is projected to increase at a CAGR of 10%.

The market is anticipated to grow at a CAGR of nearly 13%, during the period 2022-2035

In terms of type of cancer, ADC therapeutics targeting solid tumors (48%) are anticipated to capture the highest share; this trend is unlikely to change in the foreseen future. Further, based on type of antibody isotype, majority of the revenue share (90%) of the overall market is likely to be driven by IgG1 antibodies. While the focus has been on forecasting the market till 2035, the report also provides our independent view on various technological and non-commercial trends emerging in the industry. This opinion is solely based on our knowledge, research and understanding of the relevant market gathered from various secondary and primary sources of information.

For additional details please visit https://www.rootsanalysis.com/reports/view_document/adc-contract-manufacturing-market/218.html or email [email protected]

You may also be interested in the following titles:

- Targeted protein degradation market, 2022-2035

- Single-Use Upstream Bioprocessing Technology / Equipment Market, 2022-2035

About Roots Analysis

Roots Analysis is one of the fastest growing market research companies, sharing fresh and independent perspectives in the bio-pharmaceutical industry. The in-depth research, analysis and insights are driven by an experienced leadership team which has gained many years of significant experience in this sector.

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091