Key Inclusions

- An executive summary of the insights captured during our research, offering a high-level view on the current state of the antibody drug conjugate market and its likely evolution in the mid-to-long term.

- A brief introduction to antibody drug conjugates, highlighting their historical background, as well as information on their structure, advantages, and the pharmacokinetic properties of these antibody-drug conjugates.

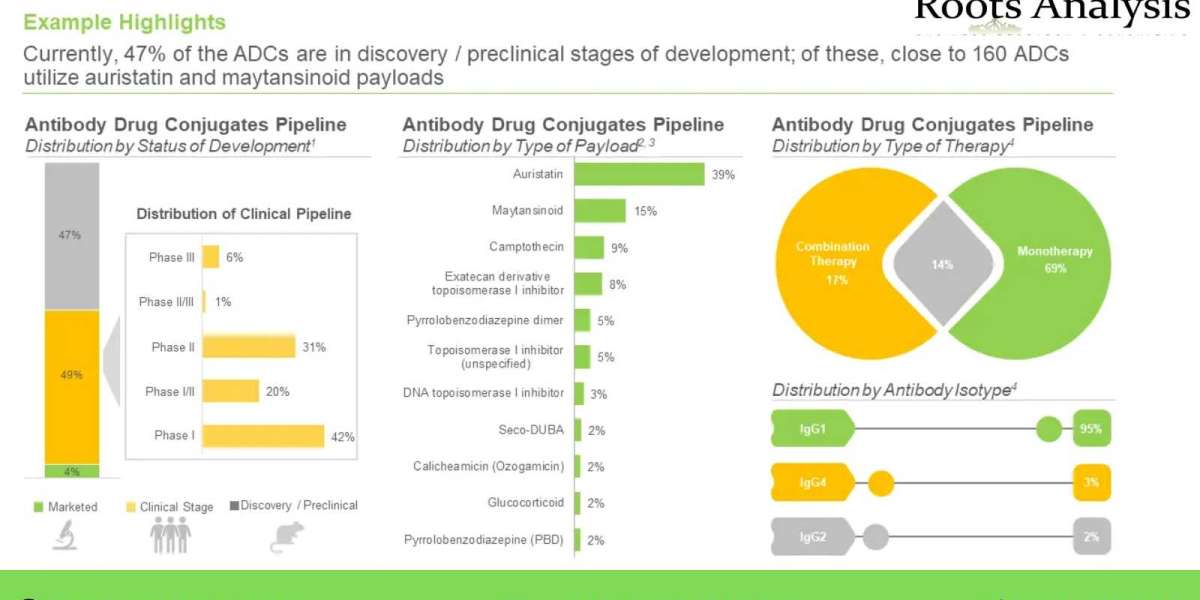

- A detailed assessment of the market landscape of close to 400 antibody drug conjugates / ADC therapeutics that are either approved or being evaluated in different stages of development (clinical or pre-clinical), based on several relevant parameters, such as status of development (Approved, Phase III, Phase II, Phase I and Discovery / Preclinical), target disease indication (breast cancer, lung cancer, gastric cancer, ovarian cancer, non-Hodgkin’s lymphoma, hepatic cancer, b-cell lymphoma, acute myeloid leukemia, brain cancer and renal cancer), therapeutic area (solid tumors, hematological cancers, autoimmune disorders / inflammatory disorders and others), line of treatment (1st line, ≥1st line, 2nd line, ≥2nd line, 3rd line, ≥3rd line, ≤4th line, Last line and others), dosing frequency (q3 weeks, q2 weeks, q1 weeks, q4 weeks, once and q6 weeks), type of therapy (combination therapy and monotherapy), target antigen (HER-2 (ERBB2), Trop-2, EGFR, FOLR1 (folate receptor alpha), CD30, B7-H3 (CD276), Nectin 4 and c-MET), antibody isotype (IgG1, IgG2 and IgG4), payload / cytotoxin / warhead (monomethyl auristatin E (MMAE), DM4, DM1, SG3199, SN-38 / irinotecan, duocarmycin and monomethyl auristatin F (MMAF)), type of payload (auristatin, Maytansinoid, camptothecin, exatecan derivative topoisomerase I inhibitor, pyrrolobenzodiazepine dimer, topoisomerase I inhibitor (unspecified), DNA topoisomerase I inhibitor, Seco-DUBA, calicheamicin (ozogamicin), glucocorticoid and pyrrolobenzodiazepine (PBD)), linkers (valine-citrulline, peptide linker, tetrapeptide-based linker, N-succinimidyl 4-(2-pyridyldithio) -butanoate (SPDB), valine-alanine, succinimidyl-4-(N-maleimidomethyl) cyclohexane-1-carboxylate and maleimide linker) and type of linkers (cleavable and non-cleavable). In addition, the chapter features information on various antibody drug conjugate developers, based on their year of establishment, company size, location of headquarters and most active players (in terms of number of therapies).

- An insightful competitiveness analysis of biological targets, featuring a (A) three-dimensional bubble representation that highlights the targets that are being evaluated for antibody drug conjugates development, taking into consideration number of antibody drug conjugates being developed against them, number of unique target disease indications and number of companies developing antibody-drug conjugates for the target, and (B) a six-dimensional spider-web analysis, highlighting the most popular biological targets based on a number of relevant parameters, including number of publications, number of grants received to support research on a particular target, number of companies involved in drug development based on a singular target, highest phase of development for the singular target, number of therapies and number of indications.

- Elaborate profiles of leading antibody drug conjugate companies (shortlisted based on sales revenue of 2022) and their respective product portfolios. Each profile features a brief overview of the company, its financial information (if available), product portfolio, recent developments, and an informed future outlook.

- Elaborate profiles of marketed ADC therapeutics; each profile features an overview of the therapy, its mechanism of action, target antigen, linker, payload, type of therapy and details related to sales generated (wherever available).

- An in-depth analysis of completed, ongoing, and planned clinical studies of various antibody drug conjugates, based on several relevant parameters, such as trial registration year, trial status, trial phase, enrolled patient population, type of sponsor / collaborator, target population, study design, most active industry players, and non-industry players (in terms of number of trials) and key geographical regions.

- An insightful analysis, highlighting the key opinion leaders (KOLs) investigating clinical trials related to antibody drug conjugates, based on several relevant parameters, such as type of KOL, qualification(s), type of organization, affiliated organization, geographical location of KOLs and target disease indications. In addition, the chapter highlights the most prominent KOLs, based on our proprietary and third-party scoring criteria.

- An assessment of various therapeutics that are being evaluated in combination with antibody-drug conjugates. The study also presents the likely evolution of these therapeutics across different indications.

- A detailed analysis of partnerships established by stakeholders engaged in this industry, since 2014, based on several relevant parameters, such as year of partnership, type of partnership (product licensing agreements, technology licensing agreements, research and development agreements, clinical trial agreements, mergers / acquisitions, product development agreements, technology utilization agreements, product development and commercialization agreements, manufacturing agreements, technology integration agreements and others), purpose of partnership (research and development, product development and commercialization, product development, clinical evaluation, portfolio enhancement, product development and manufacturing, manufacturing, research and others) type of partner, most active players (in terms of number of partnerships)., and regional distribution of partnership activity in the market.

- An analysis of the various funding and investments made in the ADC domain, since 2014, including seed financing, venture capital financing, debt financing, grants, capital raised from IPOs and subsequent offerings based on several parameters, such as number of funding instances, amount invested, type of funding, leading companies and investors, and geographical analysis.

- An in-depth analysis of the various patents that have been filed / granted related to antibody drug conjugates. It includes information on key parameters, such as type of patent, patent publication year, patent application year, geographical location, type of players, assigned CPC symbol, type of organization, and leading industry / academic players (in terms of size of intellectual property portfolio). It also includes a patent benchmarking analysis and a detailed valuation analysis.

- A study of the various grants that have been awarded to research institutes engaged in conducting research related to antibody drug conjugates, since 2016, based on various important parameters, such as year of grant award, amount awarded, funding institute center, support period, type of grant application, purpose of grant award, activity code, study section involved, popular NIH departments (based on number of grants awarded), prominent program officers, leading recipient organizations and key regions

- An elaborate discussion on commercialization strategies adopted by various drug developers for their respective products, prior to product launch, during / post launch, featuring a proprietary framework, highlighting the necessary steps and guidelines that the companies endorse while developing a marketing strategy.

- An analysis of the key promotional strategies that have been adopted by the developers of marketed products, namely Adcetris, Besponsa, Enhertu, Kadcyla, Mylotarg, Polivy, and Trodelvy.

- An insightful success protocol analysis of recently approved ADC therapeutics, based on several relevant parameters, such as dosing frequency, drug efficacy, drug exclusivity, fatality rate, geographical reach, intra-class competition, line of treatment, prevalence, price, type of therapy, and existing competition among developers.

- An overview on of various conjugation and linker technologies along with their types that are presently being employed in the designing and development of antibody drug conjugates; in addition, it presents a list of the conjugation and linker technologies that are presently being employed in the designing and development of antibody drug conjugates.

- An overview of the studies conducted to better analyze non-clinical data and support first-in-human (FIH) dose selection in antibody drug conjugates. The chapter presents findings from various antibody drug conjugate studies in different animal models. It also includes an analysis of different methods used in estimating FIH doses. In addition, it highlights the possible FIH starting doses and estimated dose escalations required to reach human maximum tolerated dose (MTD).

- An elaborate discussion on various factors that form the basis for the pricing of antibody drug conjugate products, featuring different models / approaches that pharmaceutical companies may choose to adopt while deciding the price of their respective lead therapy candidates that are likely to be marketed in the coming years.

- A case study on manufacturing of antibody drug conjugates, highlighting the key challenges, and a list of contract service providers that are involved in the ADC market.

- A case study on companies offering companion diagnostics that can potentially be used to make treatment related decisions involving antibody-drug conjugates, providing information on the geographical location of key diagnostic developers, affiliated disease biomarkers, assay techniques involved, target indications, the type of sample required (tumor tissue, blood, bone marrow and others) and the drug candidates for which a particular test was developed.

- A discussion on affiliated trends, key drivers, and challenges, under a comprehensive SWOT framework, which are likely to impact the industry’s evolution, including a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall industry.

The report also features the likely distribution of the current and forecasted opportunity across important market segments, mentioned below:

- Target Disease Indication

- Breast cancer

- B-cell Lymphoma

- Lung Cancer

- Multiple Myeloma

- Acute Lymphoblastic Leukemia

- Gastric Cancer

- Renal Cancer

- Cervical Cancer

- Other Disease Indications

- Therapeutics Area

- Hematological Cancer

- Solid Tumors

- Linker

- Inhibitory

- Stimulatory

- Valine-Citrulline

- Succinimidyl-4-(N-maleimidomethyl) cyclohexane-1-carboxylate

- Tetrapeptide-based Linker

- Maleimide

- Maleimidocaproyl

- Valine-Alanine

- Hydrazone (4-(4-acetylphenoxy) butanoic acid (AcBut)

- Other Linkers

- Payload

- Monomethyl Auristatin E

- DM1

- Duocarmycin

- SN-38 / Irinotecan

- Monomethyl Auristatin F

- SG3199

- Ozogamicin

- DM4

- Other Payloads

- Target Antigens

- HER-2 (ERBB2)

- CD79b

- TROP-2

- BCMA (TNFRSF17 / BCM)

- CD19

- CD22

- Tissue factor

- CD30

- CEACAM5

- Nectin 4

- Others Target Antigens

- Key Geographical Regions

- North America

- Europe

- Asia-Pacific and the Rest of the World

Key Questions Answered

- What are ADCs / antibody drug conjugates?

- How many antibody drug conjugates are available in the market?

- What is the mechanism of action of antibody drug conjugates?

- What are the most common antigens targeted by antibody drug conjugates?

- How many companies are developing antibody drug conjugates?

- Which are the key companies in the antibody drug conjugate market?

- What is the partnership and collaboration trend in the antibody drug conjugates industry?

- How big is the ADC market?

- What is the top selling antibody-drug conjugate?

- What is the growth rate of antibody drug conjugate market?

- Which region has the highest growth rate in the antibody drug conjugates market?

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/antibody-drug-conjugates-market/270.html

Learn from experts: do you know about these emerging industry trends?

Unlocking the Potential of Digital Twins in Healthcare: Benefits, Challenges and Opportunities

Investment Opportunities in Women’s Digital Health

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415